A crypto or cryptocurrency is a digital or virtual currency that is secured by cryptography. The key feature of cryptocurrency is decentralization meaning it works on blockchain technology having no central or governmental control. Investing in crypto has become one of the most trending investments among investors for its high potential profit. But, when it comes about investing in crypto, there are few things to be considered like what are the benefits or risks of cryptocurrencies, safety of cryptocurrencies and best ways to store them.

Why Cryptocurrency Is Popular

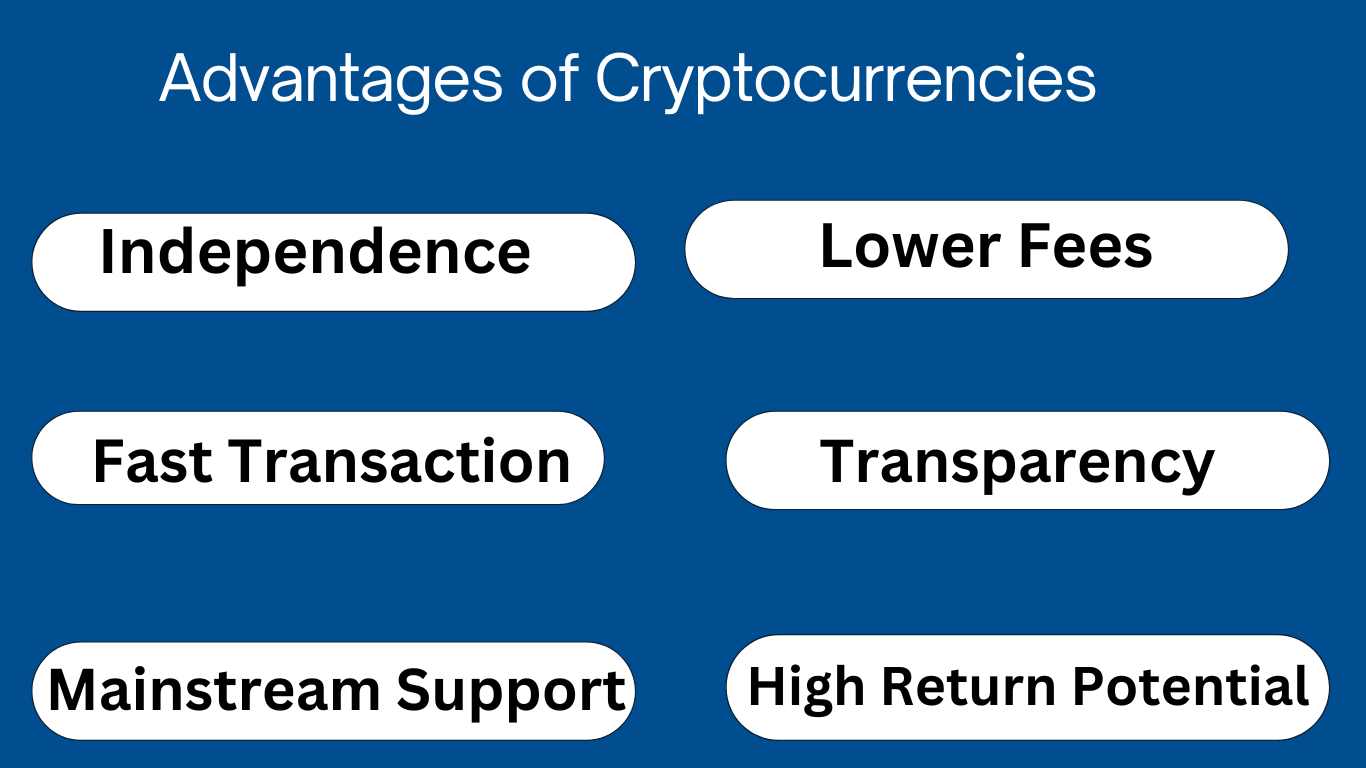

Though there is a little bit of risk both in case of security and loss manipulation, cryptocurrencies have the higher profit potentiality as a lot of people have become millionaires just by only investing a couple of hundred dollars. So, if you can manage your risks, you may become millionaires as well. Here are some benefits of cryptocurrency like:

Independence

Cryptocurrency is a decentralized virtual currency which is not controlled by any single government or central bank. A user has full control to access his coins whenever and wherever he wants to send or receive his assets., but he must take full responsibility to keep them safe.

Lower fees and Fast Transaction

Another important feature of cryptocurrency for being so popular is its lower fees and fast transactions. If anyone wants to make any international transaction within a bank or any other centered-controlled medium, he must pay high transaction fees and in some cases it may take hours. But in the case of crypto, it can be done with 5X-10X lower fees compared to any systematic ways and this happens within a few seconds.

Transparency

Cryptocurrencies are operated on blockchain technology which is fully public and immutable. This can not be changed, manipulated or even deleted and every transaction can be seen or tracked. Enhanced regulatory measures, better self-governance within crypto platforms, and increased public education about cryptocurrency have led this financial ecosystem supreme unlike traditional financial systems.

Mainstream Support

As cryptocurrency is growing fast, mainstream financial institutions and businesses have started showing their keen interest by offering special offers in cryptocurrency payments. A lot of world leading business institutions like Tesla support cryptocurrency payments.

High Return Potential

Though cryptocurrencies are highly volatile, they have high return potentiality as well. In its bull-run, a coin may rise 200-300 percent in a day and some of the coins may rise 1000-2000 Percent in the whole bull-run making millions of people millionaires

Why Cryptocurrency Is Risky

Investing in cryptocurrency is a risky investment compared to other assets like stocks and government bonds. Here are some important points to be considered for cryptocurrency risk:

User Risk

If a user makes a cryptocurrency transaction, he can not reverse or cancel the transaction in case of sending in the wrong address unlike other traditional finance. It’s estimated that about one-fifth of all bitcoins are now inaccessible due to lost passwords or wrong sending addresses. So, user should be careful when making any transaction like ensuring the correct address and selecting the right chain

Volatility

Cryptocurrency is a highly volatile currency meaning its prices fluctuate quickly and frequently showing high highs and low lows ,for instance, Bitcoin price can go down thousands of dollars in a day . But it has both pros and cons as a pro-trader can make thousands of dollars in a day capitalizing this opportunity.

Regulatory Uncertainties

As cryptocurrency is not controlled by any authority or government, it has no authoritative regulation. Thus, investor must ensure their own regulation deeply, though the Security and Exchange Commission has told that some cryptocurrencies like Bitcoin, Ethereum, BNB and Salona (but not all) cryptocurrencies can be considered as “securities” By practicing these laws and regulations, they can ensure their safety nets against trading pitfalls.

Counterparty Risks

Exchanges are the most popular platforms to store or hold crypto. About 90 percent of investors, store their cryptocurrencies in exchanges. Sometimes exchanges may be vulnerable to hacking or bankruptcy and if this happens, investors can lose all of their investment. So, choosing the best exchanges will reduce the possibility of losing your hard earned cash.

Securities and Scams

All cryptocurrencies or trading platforms are not equally created. Some platforms are more secure than others; some newly listed coins have a high probability of scams. If you lose your cryptocurrencies, it will not be possible to get them back or reimbursed. So always research thoroughly before taking any action.

Cryptocurrency Safety

It requires a high conscious effort to protect your digital crypto assets. You have to be proactive to save your cryptocurrency because once your asset is hacked or stolen, it’s not possible to get it back. Here are some key points to abide by to ensure the safety of your digital assets:

- Use strong and unique passwords

- Enable two-factor authentication

- Use hardware wallets for long-term storage

- Beware of phishing attacks

- double check wallet addresses

- Update software regularly

- avoid public Wi-fi for crypto transaction

- Backup your wallet

- Don’t share private keys or seed phrases

- Use Reputable exchanges

- Monitor for unusual account activity

- Be caution with Defi and DApps

- Use multi-signature wallets

- Do thorough research before investing in new cryptos

- Consider Using a VPN for enhanced privacy

- Keep your operating system and devices secure

- Stay informed about regulatory changes

Storing Cryptocurrencies safely

When it comes to storing or holding cryptocurrencies for long-term, the question which arises is how to store them safely?. Holding your cryptos in wallets is the most popular way to store them safely, because though exchange is better for easy trading, you don’t have full control over exchanges. So, it’s not safe to store them in exchanges for long term compared to wallets.

What Is a Crypto Wallet?

A crypto wallet is a piece of software where you can store your cryptocurrencies. You can use these wallets to have the ownership of a particular crypto account or address and store your cryptocurrencies securely to authorize crypto payments to employees or merchants.

The key difference of a wallet from that of an exchange is that it does not live on the internet unlike an exchange. If a hacker or scammer wants to get your crypto out of your personal wallet, he must attack your personal wallet which is less vulnerable to exchanges. Moving your cryptocurrencies into a private wallet is the most effective way to protect your cryptos. There are two types of Wallets:

1.Hot Wallets

2.Cold Wallets

Hot Wallets vs. Cold Wallets

A hot wallet is connected to the internet which is generally downloaded from the websites or mobile app stores whereas a cold wallet is a piece of paper or hardware wallet which can not be downloaded from the internet, they can only be purchased or created. If you want to use your crypto on a daily basis or trade regularly, a hot wallet is better than cold wallet but if you are thinking about buying and holding them for long-term, a cold wallet is best.

Using Hot Wallets to Store Crypto

First download your hot wallet from the official website, don’t download it from any social media or search result run by ads. After installing the app, open the app and you will be given a set of seed words which will be used for generating crypto accounts and addresses. Store these seed words very carefully in a piece of paper, don’t take any screenshot of your wallet and keep it on any online platform like Dropbox or Google Drive.

After recording your seed words carefully, you will be asked to set your passwords. Set a strong password with numbers, capital and lowercase letters and special characters, so that no one can easily enter. If you forget your passwords, you can restore your account using seed words.

After completing these tasks you will be taken to your crypto address which is a long string of characters used to receive and send cryptocurrency. When you withdraw your cryptocurrency from an exchange, your exchange will ask you to use this address on a specific chain. Your address may differ from chain to chain like Ethereum, BNB, Solana and many others among dozen of chains. So,. don’t type your address rather copy and paste them and choose the right chain when you are sending your crypto, because you will lose your cryptos in case of changing even one characters

As your crypto is in your hot wallet, you need to make sure the safety of your hot wallet by keeping your secret recovery phrases or seed words safely. You can create a number of accounts using private keys, a string of characters used to sign transactions and to prove that you are the owner of your account, within a single set of secret recovery phrases.

Your secret recovery phrases are stored in a file called a key vault. This file is encrypted with your passwords and when you make any transaction or browse crypto-enabled websites, your wallet opens the password pop-up menu to decrypt this file. If a hacker or scammer tries to get your crypto, he must steal both your key vault and password. He won’t be able to access your crypto only having one of these rather needs both.

Using Cold Wallets to Store Crypto

Though a cold wallet is safer than that of a hot wallet, using a cold wallet is costly and not suitable for a daily user. It’s impossible for any hacker to steal your cryptocurrency from a cold wallet except through physical theft.

Hardware wallet is the most popular among cold wallets A hardware wallet is a small USB device that stores a keystore file. You have to connect your hardware wallet to your PC or mobile device and send a signature through the USB port, if you want to make a transaction. The risk of using a hardware wallet is physical theft. If any security expert gets physical possession of your hardware wallet, your wallet may be hacked using very sophisticated techniques. So, you must transfer your crypto as soon as you realize that your hardware wallet is lost.